Posted on September 29, 2008

Refundable-oney

Tax credits are not tax cuts

by

Daniel Clark

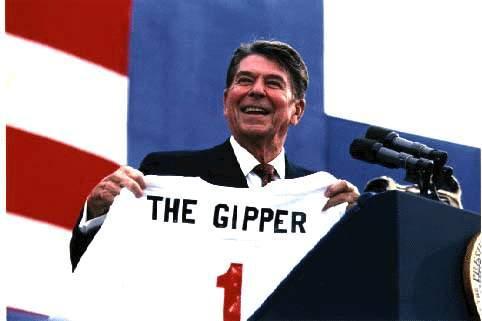

When Barack Obama positions himself as a fiscal conservative, he's not just kidding around. He fully expects the voters to accept this characterization, as evidenced by the tax plan from his campaign's website. The six-page policy statement evokes the name of Ronald Reagan five times, while promising to cut the taxes of 95 percent of all Americans.

In fact, there are many items in Obama's plan that would make him very unpopular among his fellow Democrats, if only they thought he meant them. Among them are pledges to renew most of the Bush tax cuts, eliminate capital gains taxes for small businesses, repeal most estate taxes, reduce farm subsidies, and pursue a constitutionally viable line-item veto. If sincere, these promises amount to the most brazen act of economic heresy committed by any Democrat since Jerry Brown proposed a flat income tax.

If these proposals are intended to mimic Reagan, however, they only succeed insofar as they recall his famous line from King's Row, "Where's the rest of me?"

The bulk of the Obama plan, and the basis for his 95 percent claim, is a series of proposed "refundable tax credits." What exactly is meant by this is obscured by typically dubious IRS terminology. A "non-refundable" tax credit is one that is deducted from the amount of the taxes one owes. Since most of us have our taxes withheld before such a credit would be factored in, this results in an overpayment, which means that we will then receive refunds for our "non-refundable" tax credits.

Whereas a "non-refundable" tax credit cannot exceed the amount of taxes owed, a "refundable" one may. In other words, it "refunds" taxes that have not been paid in the first place. The Earned Income Tax Credit is an example, in that it is "refunded" only to those who have earned so little that they haven't paid any income taxes. Of course, if there is no tax to cut, then the "refund" from a "refundable tax credit" is not a tax cut. Rather, it is direct wealth redistribution, by which the government seizes the earnings of some Americans, and hands them out to others, all in a single motion.

Among Obama's "refundable tax credits" are a so-called "Making Work Pay" credit of $500 for individuals or $1,000 for couples filing jointly, a $4,000 college tuition credit, a 10 percent mortgage interest credit, an expansion of the EITC, the expansion and making "refundable" of the Child and Dependent Care Tax Credit, the expansion and making "refundable" of the retirement Savers' Credit, and a health care credit of unspecified magnitude.

Who among Obama's fellow fiscal conservatives knew that an allowance from Uncle Sam was necessary to "make work pay"? Most of them probably thought that work pays because an employer must compensate his employees so that they'll agree to work for him. As it happens, work doesn't really pay until The Ones We've Been Waiting For descend from the clouds and start administering "economic justice."

Let's assume, for the sake of argument, that he's serious about his proposed tax cuts and spending controls, and that, as president, he includes them in the budget he presents to a Democrat-controlled Congress. By the time the finished bill found its way to his desk, those measures would be stripped out of it, while the massive taxpayer-funded giveaways would remain. Does anybody believe he'd do the fiscally conservative thing, and veto it?

If Obama is intent on constructing a massive new welfare state (and he is), John McCain is at least willing to help lay the cornerstone. The Republican candidate is proposing a $5,000 "refundable" health care tax credit of his own. At least for this election cycle, the argument over whether the government should be redistributing wealth appears to be over. The only disagreement is over how much.

During his August 16th interview with pastor Rick Warren, Obama said that he'd been concerned about the Republican welfare reform bill that President Clinton signed in 1996, but that he's since changed his mind. That seemed like a curious admission, coming from a former "welfare rights" activist from the Association of Community Organizations for Reform Now (ACORN), who now touts that experience as a "community organizer" as qualification for the presidency.

Now we know what his idea of "reform now" is. He means to change the administration of welfare so that it is done primarily through the tax code -- and with McCain's unwitting help, to disguise it as conservative economic policy.

-- Daniel Clark is a Staff Writer for the New Media Alliance. The New Media Alliance is a non-profit (501c3) national coalition of writers, journalists and grass-roots media outlets.

The Shinbone: The Frontier of the Free Press